- Home

- Mind & body

- What to consider when choosing your excess or co-payment

At CBHS we help you manage your health challenges. We believe in offering you the services, support and tools you need to live your best life.

Health and Wellness Programs are available to support eligible members towards a healthier lifestyle. Each Health and Wellness Program is subject to its own eligibility criteria.

Contact us for more information and to confirm your eligibility for a program.

What to consider when choosing your excess or co-payment

Private health insurance has its fair share of industry jargon, so we're here to help break down those unfamiliar words. By learning some of the terms related to health cover, you're in a great position to make empowered decisions for yourself and your family. Plus, you might even save some money. So, let's jump straight into it. You might have seen the terms ‘excess’ and ‘co-payment’ when reviewing and researching different Hospital covers. So, what do they mean and how can you use them to lower the cost of your cover?

By having an excess or co-payment on your Hospital cover, you can help keep the premiums down because you’re contributing a small amount towards the cost. Depending on your Hospital product, you may have the choice of a co-payment or an excess. Some Hospital products have a pre-determined co-payment or excess built in.

An excess is a dollar amount which you will have to pay when you’re admitted to hospital. The admission could be for a day procedure or a longer stay. You pay the agreed-upon excess directly to the hospital towards the accommodation cost, then the health fund pays the remainder of the accommodation cost up to your policy limitation.

A co-payment is a daily amount that you contribute for each day/night you're admitted to hospital. This might be capped depending on the product.

If you’re looking to keep more dollars in your account each month and stretch your budget further, could a product with an excess or co-payment be right for you?

Here are some points to think about when choosing your excess and co-payment level on Hospital covers:

- Would having to pay a higher level of excess put you under financial strain? The excess amount may be required by the hospital upfront before treatment begins.

- It’s impossible to predict the future - but consider your history of claiming and likelihood of needing to be admitted to hospital.

- If you have a family, chances of needing hospital treatment may increase simply due to the policy covering more people.

- Does the cover you have, or you’re considering, have a cap on how many times a year you would need to pay an excess?

- Does the cover you have, or you’re considering, have a cap on the number of days per calendar year you’d need to pay a co-payment?

- Some covers waive the excess or co-payment for your dependants - is that important to you?

If you choose to be admitted to a public hospital as a private patient, the hospital may still ask you to pay your excess or co-payment if you have one. Check your state or territory's position on this if you think you'd like to or plan to use a public hospital as a private patient.

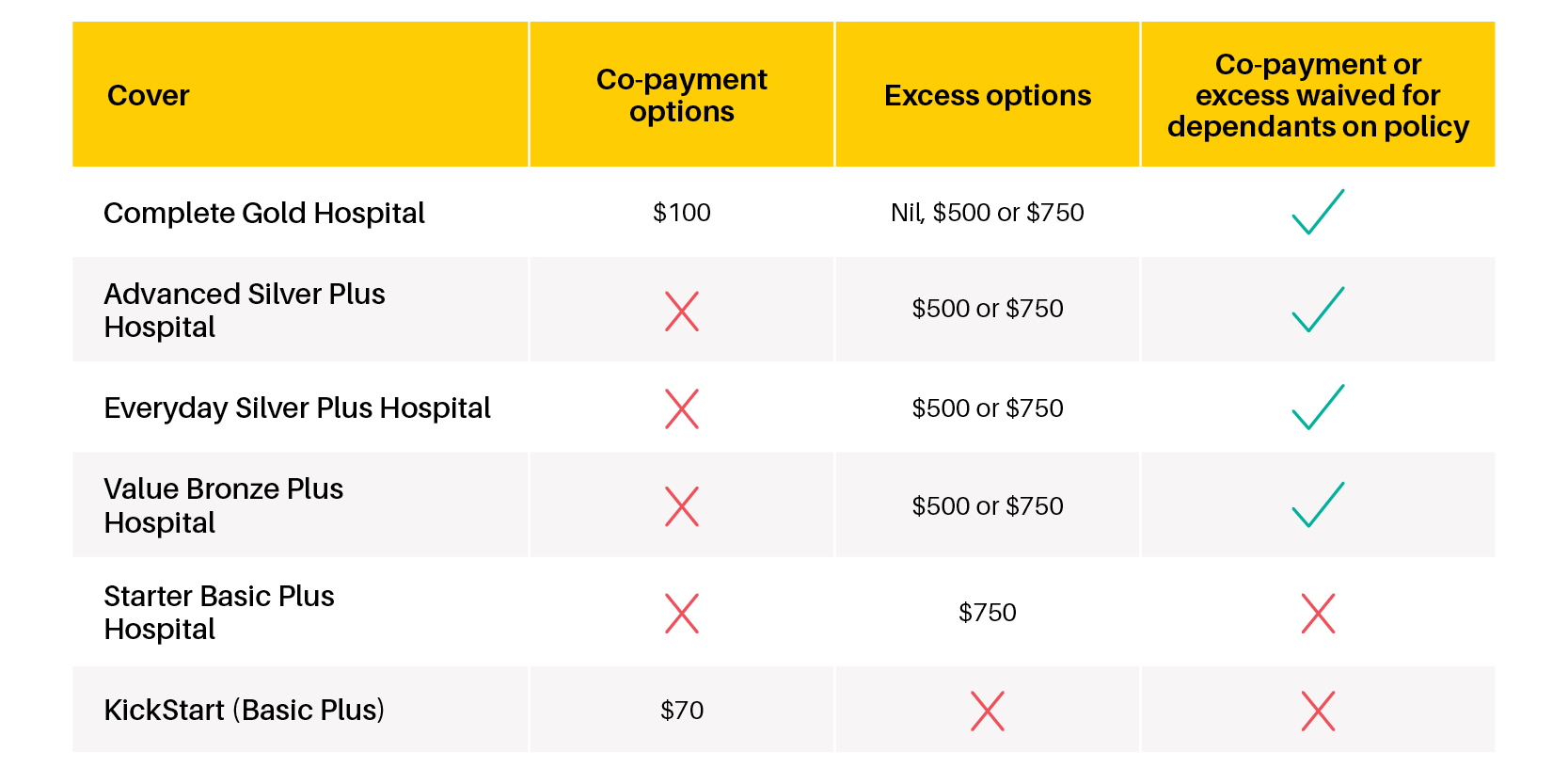

CBHS Health Fund offers excess and co-payment options

Check out our Hospital product range below, and the excess or co-payments options they offer. Our Health Care Sales Specialist team can help advise you on what would be the most suitable for your individual budget and health needs.

Want to know more?

Research and compare our Hospital cover products.

All information contained in this article is intended for general information purposes only. The information provided should not be relied upon as medical advice and does not supersede or replace a consultation with a suitably qualified healthcare professional.

Health and wellbeing

programs & support

You Belong to More with CBHS Hospital cover:

- Greater choice over your health options including who treats you

- Get care at home with Hospital Substitute Treatment program

- Free health and wellbeing programs to support your health challenges

Live your healthiest, happiest life with CBHS Extras cover:

- Benefits for proactive health checks e.g. bone density tests, eye screenings

- Keep up your care with telehealth and digital options

- Save on dental and optical with CBHS Choice Network providers