- Home

- Mind & body

- Do you have the right Hospital cover for your needs and lifestyle?

At CBHS we help you manage your health challenges. We believe in offering you the services, support and tools you need to live your best life.

Our Better Living Programs are available to support eligible members towards a healthier lifestyle. Each Better Living Program is subject to its own eligibility criteria.

Contact us for more information and to confirm your eligibility for a program.

Do you have the right Hospital cover for your needs and lifestyle?

When it comes to what you can claim with your private health insurance, there’s no such thing as ‘too much information’! In fact, the more you know, the better equipped you are to benefit throughout the year for all the services and procedures you may use. It also means you can avoid any unwanted surprises you don't want to be preparing for your procedure and realise you don’t have the appropriate level of cover you need.

As a general rule of thumb, the higher your level of cover is, the more services will be included for you to be able to claim benefits for.

To recap on what you may already know, CBHS currently offers two main types of cover including:

- Hospital

- Extras

Let’s take a quick look at them:

Hospital

As the name suggests, this offers you cover if you need to be admitted into hospital. It will help pay for things such as accommodation, theatre fees and specialist fees as an inpatient.

Extras

This is a convenient add-on because it provides benefits towards key health services including, dental, optical, physiotherapy, chiropractic and even alternative therapies that Medicare doesn’t usually cover.

We also have a pre-packaged cover...

For your convenience, we've pre-bundled up a Hospital and Extras cover if you're looking for a ready-made package. This is called KickStart (Basic Plus), an affordable cover designed for the fit and healthy.

“The more you know about your private health insurance cover, the more you can enjoy the benefits all year round.”

Staying in the know on inclusions

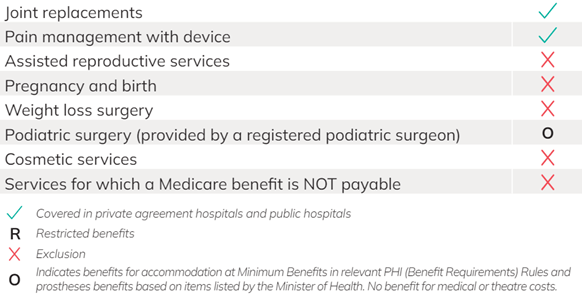

To help you, we’ve also included an at-a-glance look at the meaning behind the symbols you’ll see on a typical policy inclusions list.

The green ticks for ‘Included’ mean particular Hospital service category is included in your policy.

If you see a ‘Restricted’ (R) icon, that means you won’t be fully covered for that service. You may only be covered as a private patient in a public hospital. It’s best to check with us before you go ahead with procedure so we can let you know how much you might end up out-of-pocket.

The ‘Excluded’ red cross is applied to items which you are not covered for under your current level of cover.

You might also spot an O for ‘Benefits for accommodation at MBS’. This also means you’re not fully covered for that service and we might only cover a portion of your hospital accommodation, but no theatre or specialist fees.

It’s also important to remember that having private health insurance doesn’t necessarily mean you’ll be able to skip public hospital waiting lists. If you're only covered for public hospital or need to have your procedure done in one, the waiting lists would apply.

Let’s talk about tiers

Did you know that it’s mandatory for all private health funds to place their Hospital covers into tiers? There are four base tiers in total:

- Basic

- Bronze

- Silver

- Gold.

In fact, all hospital products must have a ‘tier’ in its name. This helps you to compare products easily within a health fund and between funds.

If you see the 'Plus' after the tier, e.g. 'Bronze Plus' it means that we have added additional coverage above the minimum requirements for that tier.

You can find out more about this Government mandate for all health funds by visiting the Department of Health website.

For your peace of mind, it’s a great idea to double-check your cover and confirm what you can claim.

Excess and co-payments

While you’re refreshing your memory on the type of private health insurance you have with CBHS, you can also check if you have an excess or a co-payment as part of your cover.

This is the number in the ‘title’ of your policy. If it’s 70 or 100, that means you will have a daily co-payment of that amount if you go to hospital. If it’s 500 or higher than that's the excess you'll pay on your hospital stay.

Co-payments and excess amounts are designed to keep your premium costs more affordable. You can find out all about co-payments and excess in our article.

For example:

- Value Bronze Plus Hospital 500 indicates you have a $500 excess on Hospital admissions.

Login to your Member Centre to check your cover details.

Be aware of your waiting periods

If you’re new to private health insurance, waiting periods will apply and vary depending on the service or procedure you need. However, it’s important to note that waiting periods also apply if you’re an existing CBHS member or have transferred from another fund and wish to upgrade to a higher level of cover.

In essence, waiting periods apply to all levels of Hospital cover and packaged cover (except in case of an emergency or accident). So, make sure you’ve served your specific waiting period before you book a procedure or surgery.

If you have any questions on waiting periods, we can help take the mystery out of these as well. Get in touch with our Member Services team for guidance and extra details.

Did you know going to an agreement hospital will save you on out-of-pocket costs?

CBHS has many contracts in place with a large range of hospitals all over Australia – these are called agreement hospitals. And when you choose to have your procedure (for an included service) at an agreement hospital, you’ll be covered for:

- Inpatient accommodation (i.e. your hospital stay, meals, nursing care)

- Operating theatre

- Labour ward (if you have pregnancy & birth cover)

- Intensive care

- Surgically implanted medical devices and human tissue products on the Government’s Prescribed List of Medical Devices and Human Tissue Products (if you’re covered for that procedure).

Remember, CBHS have agreements with most private hospitals that our members are likely to access. If you choose to use a non-agreement or public hospital, you may incur out-of-pockets expenses and waiting lists.

The specialist you choose can also save you on out-of-pocket costs

Did you know that medical professionals set their own fees too? Just like many of the goods and services we buy.

A doctor chooses what they’ll charge, and it’s up to the market (you) to decide if they will pay that or look elsewhere. And you’re totally entitled to do that! It’s also important to note that when a doctor charges above the MBS fee the Government has set for that service, there’ll be an out-of-pocket cost to cover.

When you’re choosing a specialist, you can help reduce your costs by asking them to participate in CBHS’s Access Gap Cover (AGC). You can search for doctors who have treated people under AGC in the past using our Access Gap Cover search engine.

The search results will show the doctors based on your chosen speciality and postcode and you can select each one to see an estimate of what other CBHS members paid. Take a look at the example below:

Doctors/specialists choose to take part in Access Gap Cover on a case-by-case basis, so you'll have to ask if you can be treated under this.

More details on AGC

If you have a specialist in mind, you can ask your GP to give you a referral to them. Otherwise, your GP can provide an open referral so you can do some research before choosing. Once you have found someone you’re happy with, you can ask for what’s called, Informed Financial Consent, or IFC. This is a document detailing all the estimated costs for your treatment, including any out-of-pocket costs.

We’ve got more details on choosing a doctor and how to ask for IFC in this article.

If in doubt, we’re here to untangle your cover questions

If you know you have a hospital treatment or surgery coming up, you should always make sure your level of private health insurance with us will cover the reason for your hospital stay. If you’re not certain, please contact us. Our Member Services team is always happy to help.

We can guide you on the steps you need to take and make the most of your cover. And remember, for all questions on waiting periods, check this article or talk to us.

We’re committed to helping you feel confident about your cover when you have an upcoming procedure or treatment.

Just like life, health needs are always changing. Let us review your current cover

They say that the one constant in life is change. This is certainly true when it comes to private health insurance and your individual healthcare needs.

In fact, health cover is not ‘set and forget’. That’s why it’s important to check your health insurance regularly. Every 12 months is a good timeframe. Your circumstances may change, and medical needs can evolve too. Be in touch with what your health insurance will cover for you – and your family – sooner rather than later.

If you’re curious about reviewing your current cover, we’re happy to take care of that for you at absolutely no charge. Simply get in touch with us via phone on 1300 654 123 or log on to the CBHS app to have a chat with the Member Services team.

The confidence you feel in your health cover is important to us. So, even if you’re a little bit unsure about what your health insurance will cover, we’d love to help in any way we can. When you’re a part of the CBHS family, you really do belong to more.

All information contained in this article is intended for general information purposes only. The information provided should not be relied upon as medical advice and does not supersede or replace a consultation with a suitably qualified healthcare professional.

Sources:

Health insurance - Hospital, Extras and Ambulance Cover (cbhs.com.au)

Select a competitive hospital cover for your lifestyle (cbhs.com.au)

Different waiting periods apply for your level of cover (cbhs.com.au)

https://www.cbhs.com.au/mind-and-body/blog/finding-out-the-cost-of-your-hospital-treatment

https://www.cbhs.com.au/mind-and-body/blog/access-gap-cover-what-you-need-to-know

Health and wellbeing

programs & support

You Belong to More with CBHS Hospital cover:

- Greater choice over your health options including who treats you

- Get care at home with Hospital Substitute Treatment program

- Free health and wellbeing programs to support your health challenges

Live your healthiest, happiest life with CBHS Extras cover:

- Benefits for proactive health checks e.g. bone density tests, eye screenings

- Keep up your care with telehealth and digital options

- Save on dental and optical with CBHS Choice Network providers