- Home

- Mind & body

- Changes to the Australian Government Rebate on private health insurance income thresholds

At CBHS we help you manage your health challenges. We believe in offering you the services, support and tools you need to live your best life.

Our Better Living Programs are available to support eligible members towards a healthier lifestyle. Each Better Living Program is subject to its own eligibility criteria.

Contact us for more information and to confirm your eligibility for a program.

Changes to the Australian Government Rebate on private health insurance income thresholds

The Australian Government Rebate on private health insurance is designed to help reduce the cost of premiums, and encourage Australians to hold private health cover. This rebate is income tested, and most people claim the rebate as a reduction in the premiums they pay to their health fund. The other way to claim the rebate is as a tax offset when you lodge your annual tax return.

This year, the income thresholds for the rebate will be increasing. This means that depending on your income level, you may benefit from a higher rebate.

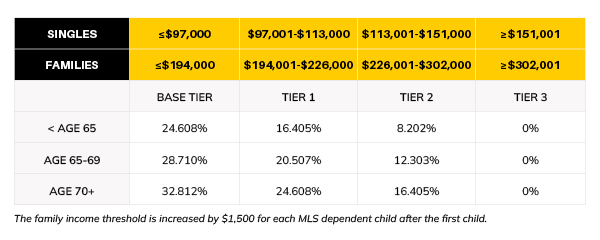

From 1 July 2024, the new income thresholds will be as follows:

What do you need to do?

You’ll need to check whether your rebate tier will change, based on the new income thresholds. If you need to update your tier, you can do this in the Member Centre or by calling us, from 1 July 2024.

Medicare Levy Surcharge

These income thresholds are also used to calculate the Medicare Levy Surcharge (MLS), which is a levy Australians pay if they earn above a certain income and do not have private Hospital cover. The MLS is calculated when you submit your tax return each year. You’ll be advised on any surcharge you need to pay when you receive your notice of assessment from the Australian Tax Office (ATO).

More information and help

Please check out our FAQs on this change. You can also find more details of these changes at the following Australian Government websites.

If you still have questions, please contact us at help@cbhs.com.au or 1300 654 123 (8am-7pm AET) Monday-Friday.

The above information is intended for general information purposes only. It has been prepared without taking into account your objectives, financial situation or needs. The information provided should not be relied upon as financial advice and does not supersede or replace a consultation with a suitably qualified professional.

Health and wellbeing

programs & support

You Belong to More with CBHS Hospital cover:

- Greater choice over your health options including who treats you

- Get care at home with Hospital Substitute Treatment program

- Free health and wellbeing programs to support your health challenges

Live your healthiest, happiest life with CBHS Extras cover:

- Benefits for proactive health checks e.g. bone density tests, eye screenings

- Keep up your care with telehealth and digital options

- Save on dental and optical with CBHS Choice Network providers