- Home

- Mind & body

- Budgeting apps to help your financial wellbeing

At CBHS we help you manage your health challenges. We believe in offering you the services, support and tools you need to live your best life.

Our Better Living Programs are available to support eligible members towards a healthier lifestyle. Each Better Living Program is subject to its own eligibility criteria.

Contact us for more information and to confirm your eligibility for a program.

Budgeting apps to help your financial wellbeing

Finances, budgeting and your health

On the surface, it might seem like your bank balance and your health have little in common. But financial health and mental health are closely linked. Financial struggles can be very stressful, whereas feeling financially secure can give you peace of mind. Similarly, poor mental wellbeing can make it harder to stay on top of your finances. It’s a two-way street.

In fact, recent Australian research found people dealing with financial challenges are at least twice as likely to experience mental health concerns than those who aren’t, and vice versa. But the good news is that you can take steps to feel more in control over your financial situation.

Why budget?

Financial wellbeing involves being in a financial position that gives you freedom to make choices and enjoy life. Right now, many Australians are feeling the financial strain of things outside of their control, like rising interest rates and low housing affordability. However, it can be helpful to look at how you’re managing your money to see where your financial choices, both small and large, impact your financial wellbeing.

Living within your means is one way to take control of your financial health, and budgeting can help you do that.

There is a whole world of possibilities out there when it comes to budgeting apps. And the good news is that most of them have extensively showcased their features. That way, you can do your own research based on which features apply to your personal situation. Most budgeting apps are available for Android or iPhone, on Google Play and App Store, so you can find the one that will suit you, your family, and your needs the best.

Here are some examples of budgeting apps available, that might help you save, plan long-term financial goals, spend wisely, and overall have a better understanding of your finances.

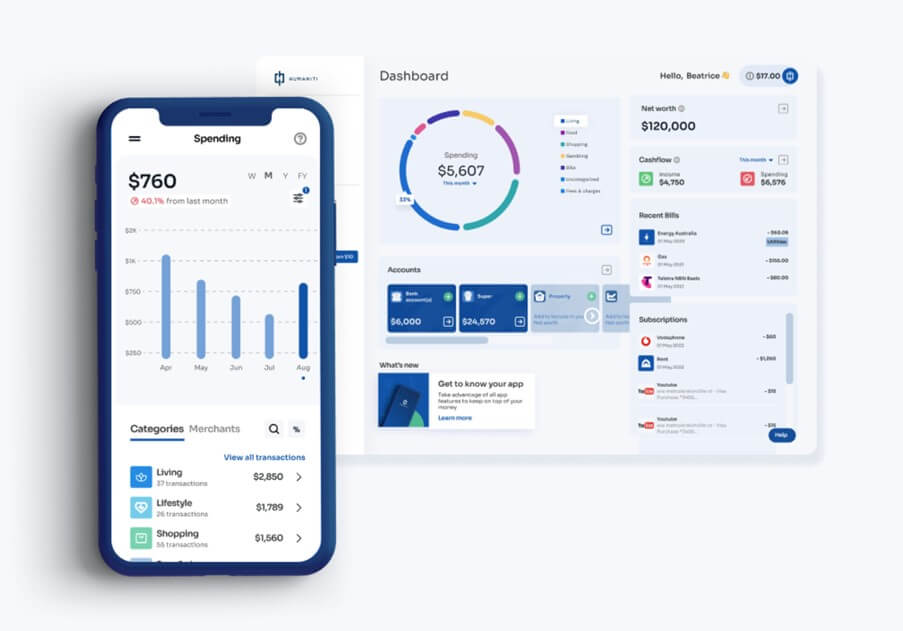

Humaniti

Humaniti is a free budgeting app presenting itself as an alternative to the now defunct MoneyBrilliant. With over 50,000 users signed up, Humaniti allows you to:

- get a complete picture of your finances by linking all your accounts

- see how you're spending money and find ways you could save

- compare your super to that of other Australians like you

- understand and track your net worth

- take surveys to earn money.

Humaniti uses bank-level encryption technology and has a principal of giving back. Humaniti donates an extra 10% to charity for every survey their members complete. So far, they have funded the purification of two million litres of water through UNICEF, as well as contributed to various other causes.

To get started, you just need to sign up and link your bank accounts.

Frollo

Frollo was awarded best money management app in 2022. It’s free and simple to use. Frollo gives you a thorough picture of your financial situation by syncing with all your accounts (including credit cards, savings, loans, investments and transaction accounts) and categorising your transactions.

Frollo allows you to:

- create a budget, match it to your pay cycle and track your progress

- see where you’re spending money

- set financial goals linked to specific accounts

- know when regular bill payments are due

- get money tips and insights to help you get ahead.

It also has a ‘Financial Passport’ function, which can help streamline borrowing by giving lenders a thorough picture of your finances.

Frollo employs bank-level security standards and an open banking platform (a system that allows accredited providers to collect and store your financial data with your permission).

After downloading the app you’ll need to link your accounts to it.

WeMoney

This free app says it’s designed to help you achieve ‘social financial wellness’ by allowing you to ‘track and crush debt’.

With WeMoney, you can:

- connect all your accounts to the app and get an overview of your money

- categorise your transactions and see where you could save

- keep track of your bills and subscriptions

- set monthly budgets and money goals

- check your credit score.

WeMoney uses bank-grade security. A paid pro-level option is also available, with additional features such as the ability to turn off ads and create unlimited custom categories.

To get started, you’ll need to create an account and provide photo ID.

Raiz

Raiz (formerly known as Acorns) is not strictly a budgeting tool, but a micro-investment app that invests your digital ‘change’ for you. For example, if you buy a coffee for $3.20, it can round the expense up to $3.50, depositing 30c into your Raiz account.

You can choose from several portfolios to invest that money in, sorted by risk/reward. It should be noted that these investments are long-term. Don’t expect to see cash flying in after a couple of weeks!

The app lets you track your investment performance, transaction history, spending, and even your environmental footprint.

Raiz also features a ‘My Finance’ function. You can link accounts to the app to get an overview of your spending and an idea of where your money is going (to ‘shopping’ or ‘food and dining’, for example).

While the app is free to download, there’s a fee to start investing.

To get started, you’ll need to:

- sync the app with your bank accounts

- choose your preferred portfolio

- schedule regular deposits

- set your contribution amount per purchase.

Your bank’s app

If you have an app from your bank, it’s worth checking whether it has a budgeting feature. Several banks categorise your spending automatically, so you won’t need another app to see where your money is going.

WiseList

While not strictly a budgeting app, WiseList could still be a great tool for keeping dollars in your wallet. It’s designed to help you save on one of the biggest expenses for many Australian households – grocery shopping.

WiseList is free and allows you to:

- plan your meals and create a grocery list (the app even has recipes)

- see the price of items at Coles and Woolworths side-by-side

- create item price alerts

- connect Flybuys and Woolworths Rewards cards to use at the checkout

- order grocery delivery from within the app

- track your bills and set reminders to help you avoid late payment penalties.

You can sign up with your phone number, email address or Facebook account.

We hope this jump-started your journey to find the ideal budgeting for you. Now, if your finances are affecting your wellbeing, check out these four ideas for managing financial stress.

Information in this article is factual information only. It is not intended to imply any recommendation or opinion about a financial product. The information has been prepared without taking into account any individual’s objectives, financial situation or needs. Readers must consider any advice in the article in light of their own objectives, financial situation or needs and if the advice relates to the purchase of a financial product, they should obtain a product Disclosure Statement on the product before making any decision about whether to purchase the product. CBHS does not have an affiliation with any applications or companies mentioned in this article and does not receive a commission, nor do we provide financial advice in relation to any information contained within this article.

Sources

https://www.headtohealth.gov.au/meaningful-life/feeling-safe-stable-and-secure/finances

https://www.canstar.com.au/credit-cards/open-banking-live-australia/

https://www.cbhs.com.au/mind-and-body/blog/eat-healthy-save-money

https://www.cbhs.com.au/mind-and-body/blog/7-top-grocery-shopping-tips-for-a-healthier-you

https://www.cbhs.com.au/mind-and-body/blog/four-ways-to-help-control-financial-stress-and-worry

Health and wellbeing

programs & support

You Belong to More with CBHS Hospital cover:

- Greater choice over your health options including who treats you

- Get care at home with Hospital Substitute Treatment program

- Free health and wellbeing programs to support your health challenges

Live your healthiest, happiest life with CBHS Extras cover:

- Benefits for proactive health checks e.g. bone density tests, eye screenings

- Keep up your care with telehealth and digital options

- Save on dental and optical with CBHS Choice Network providers